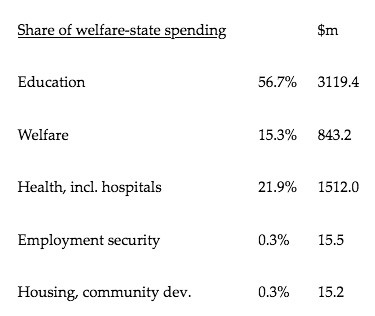

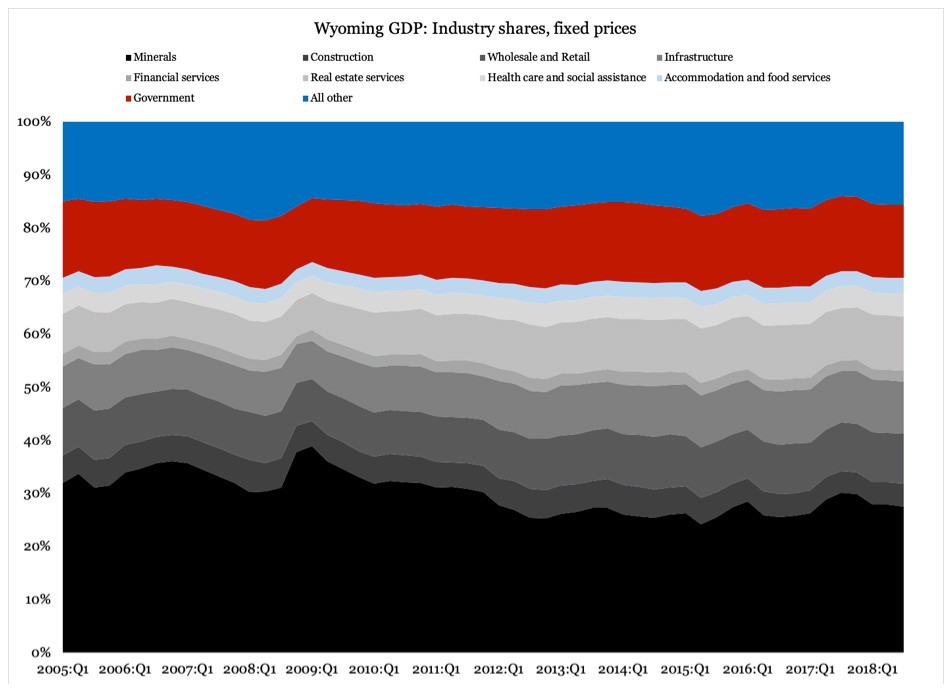

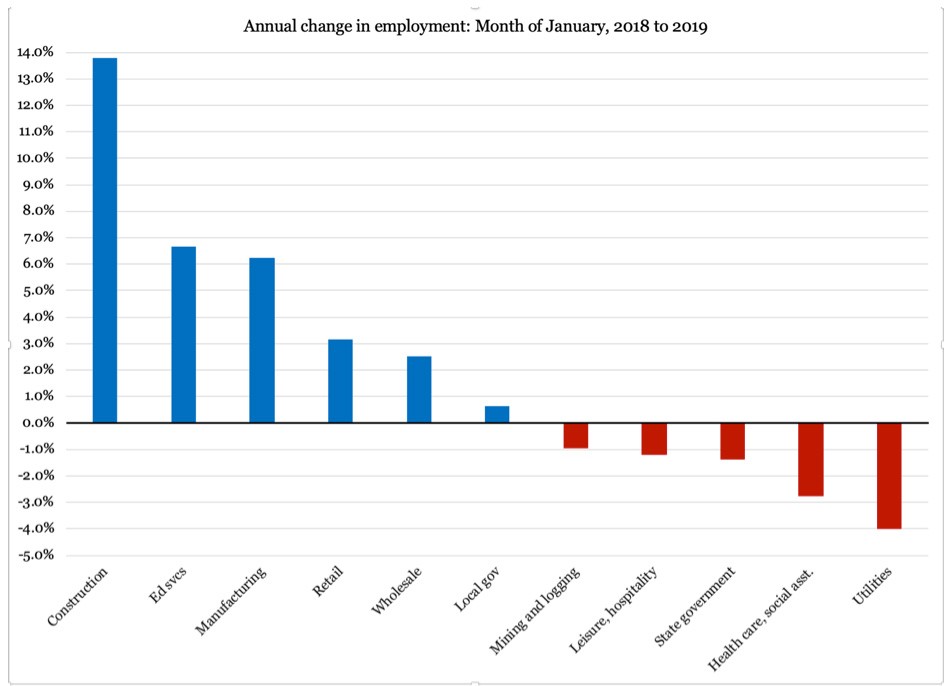

by Wyoming Liberty Group Staff The persistent deficits in the federal budget, as well as in the Wyoming state finances, are painful reminders of government overspending. Understandably, we often hear calls for drastic spending reductions, and they will become necessary soon enough, unless we begin reforming our state and local governments in the di...

Wyoming Liberty Group

P.O. Box 9

Burns, WY 82053

Phone: (307) 632-7020