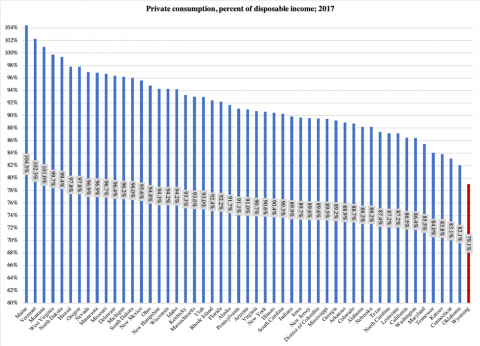

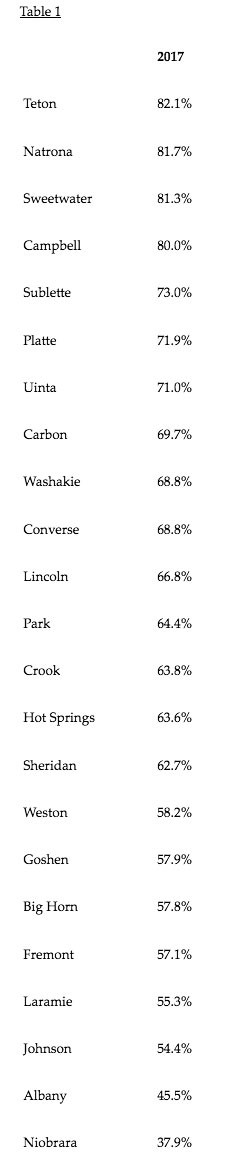

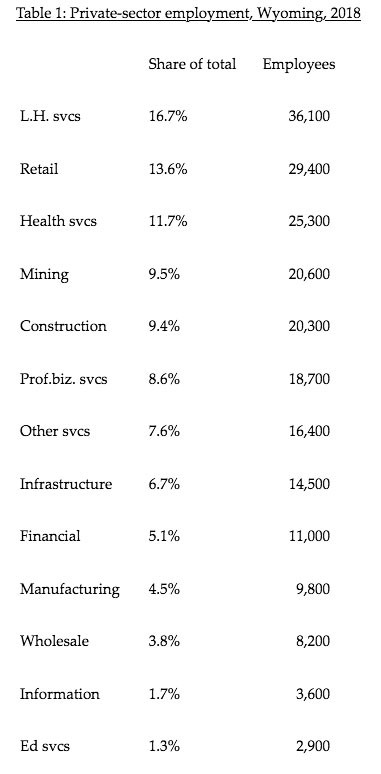

by Wyoming Liberty Group Staff A month from now the Bureau of Economic Analysis releases 2018 consumer-spending data for the states. In two parts, this Report will give an update on the recent history of consumer spending and personal income in Wyoming, compared to other states. This the first part examines personal income. Main finding: Persistent...

Wyoming Liberty Group

P.O. Box 9

Burns, WY 82053

Phone: (307) 632-7020