by Austin Hein - Policy Analyst

Foreword

Daniel J Mitchell, Ph.D. - Chairman, Center for Freedom and Prosperity

The United States economy faces considerable risk because of policy mistakes from Washington, most notably excessive government spending and debt, as well as bad monetary policy that results in artificially low interest rates and excessive leverage. There’s not much that state officials can do about those mistakes, but it is important to avoid similar policy errors that compound the damage.

Wyoming is rather unusual in that residents have a low tax burden because of a wise choice to avoid an income tax. Yet there are other revenue sources which have enabled a relatively heavy burden of state government spending. And this large state budget is vulnerable to misuse, especially with regards to “economic development” programs that, from the perspective of the Austrian School of economics, lead to a misallocation of resources. This is unfortunate since it exacerbates the malinvestment resulting from bad policy out of Washington.

It would be desirable to have a more diversified economy, of course, but it is very implausible to think that politicians and bureaucrats are capable of correctly identifying winners and losers. The track record of such programs is universally poor. Instead of this misguided form of central planning, state lawmakers should consider policies to strengthen the local economy so that private investors will feel more comfortable about Wyoming’s long-run outlook. Some sort of TABOR-style spending cap, based on Colorado’s successful system, would be very desirable.

Preface

Wyoming is still in a recession, and there is little evidence to say there will be a turnaround in any near future. Further, there is a concern for a double dip, and Wyoming is particularly susceptible. To date, the majority of the state government of Wyoming’s policy “remedies” are more harmful than helpful.

To understand the causes and consequences of a new recession, the series of booms and busts of the business cycle must be understood. In this case, the Wyoming Government’s investment spending is the primary factor in determining the future success (or lack thereof) of the economy. Using Austrian economic modeling, we can analyze the impact of Wyoming’s government interference in the economy.

National Economic Overview

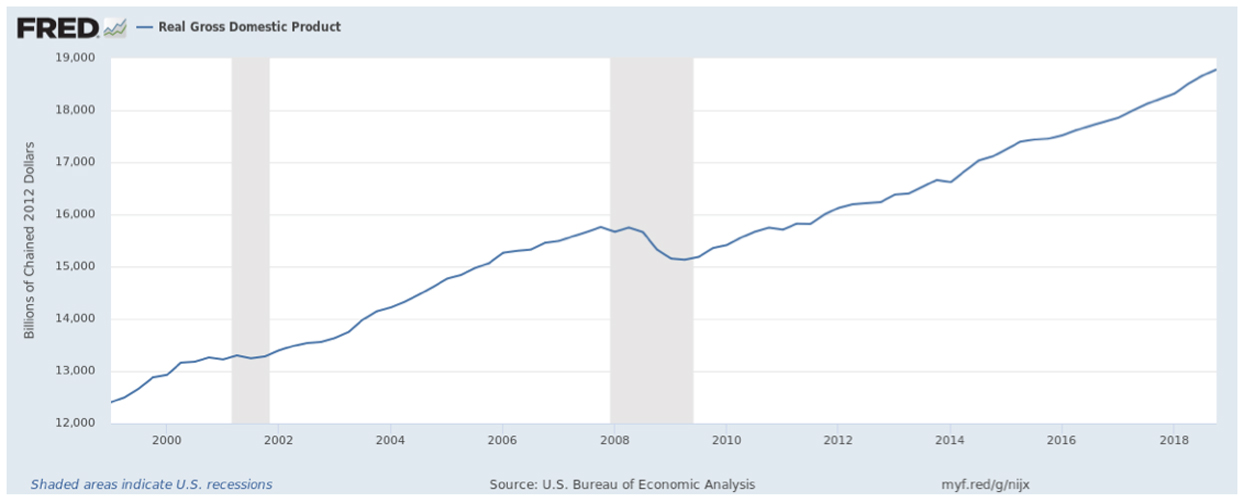

The United States’ national debt is now over 22 Trillion Dollars with a debt to GDP ratio of approximately 114%. More than 16 Trillion of the debt is held by the public as oppose to intragovernmental debt1. The United States is entering an unprecedented territory that can only be explained by the global reliance on the US Dollar. The National GDP growth rate has recently hovered around 2.3%, a rate championed by President Trump. There should be a concern that this economic growth signals yet another market bubble in a series of boom and busts our economy has experienced over the last twenty years (Figure 12).

The United States economy relies on spending increases and targeted tax cuts to stimulate economic growth, which was sluggish under the Obama administration. GDP growth can be misleading, though. Much like how a sugar high or a second cup of coffee is not a substitute for natural healthy energy from proper dieting, GDP growth can be artificially stimulated. Also like a sugar high, artificial GDP growth is always followed by a crash. This is evidenced by the 2008 recession which was preceded by massive spending increases coupled with expansionary monetary policy conducted by Alan Greenspan’s Federal Reserve.

Artificially low-interest rates inspired a malinvestment cycle that eventually led to the 2008 recession. To counteract the bust, the Bush and Obama administrations relied on bailouts and stimulus packages to jump-start the economy, or in other words, grabbed a Red Bull to turn around the sugar crash. Meanwhile, Ben Bernanke’s Federal Reserve started its first of three quantitative easing (QE) cycles to pull the United States out of the so-called liquidity trap.

To consider a future recession, the United States must learn from events that led up to the last recession and avoid making the same mistake. Janet Yellen’s monetary policy was more conservative than Bernanke’s QE ventures, as she slowly raised reserve rates during her tenure as chairwoman. President Trump’s chairman, Jerome Powell, thus far appears to be following along the same strategy Yellen set in motion.

President Trump recently voiced his criticism of the Federal Reserve’s reluctance to lower rates, claiming the Fed is trying to stifle economic growth. However, Chairman Powell seems to have backed off rate hikes for the time being, as he recently stated that he envisions no new rate hikes for 20193. If President Trump attempts to pressure Chairman Powell to be more open to lowering interest rates, the conditions for a recessionary relapse would be set.

Wyoming Economic Overview

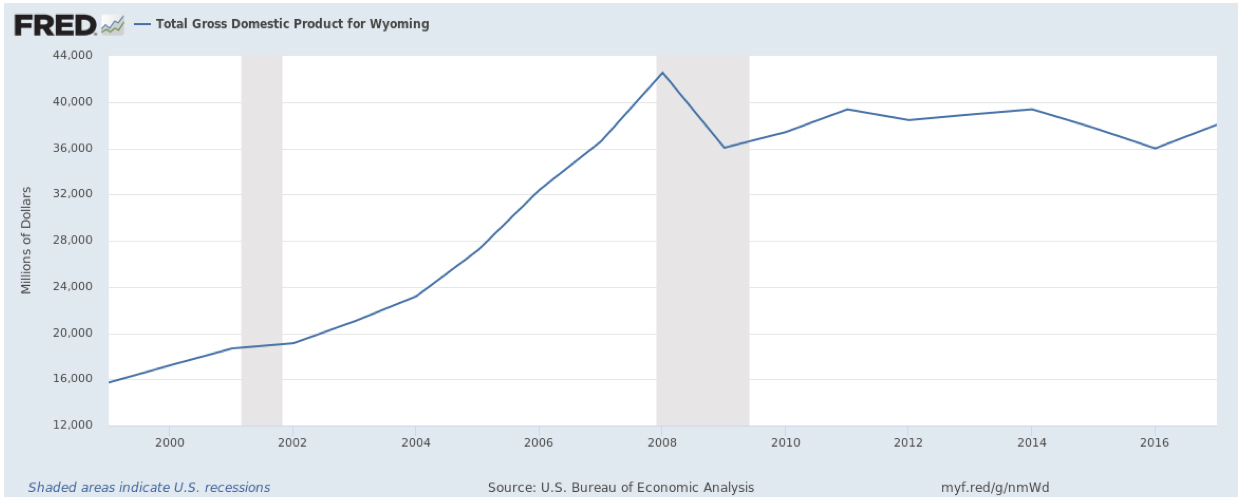

Wyoming felt the downturn just as the rest of the country did, however, Wyoming has not seen the same recovery (Figure 2)4. Wyoming’s GDP is still hovering around recessionary levels from 2008. If and when the United States economy enters another downturn, how much further can Wyoming fall?

Wyoming is among the worst states in the country in job growth since 20095. This could be due to Wyoming’s reliance on the energy sector as the prime private employer in the state. Nationally, the energy sector has been uneasy, at best, since 2009. This is the primary argument among Wyoming politicos who seek to “diversify the economy.” Unfortunately, this has been used as an excuse to expand Wyoming’s corporate welfare state to coax new industries to make their home in Wyoming.

Methodology

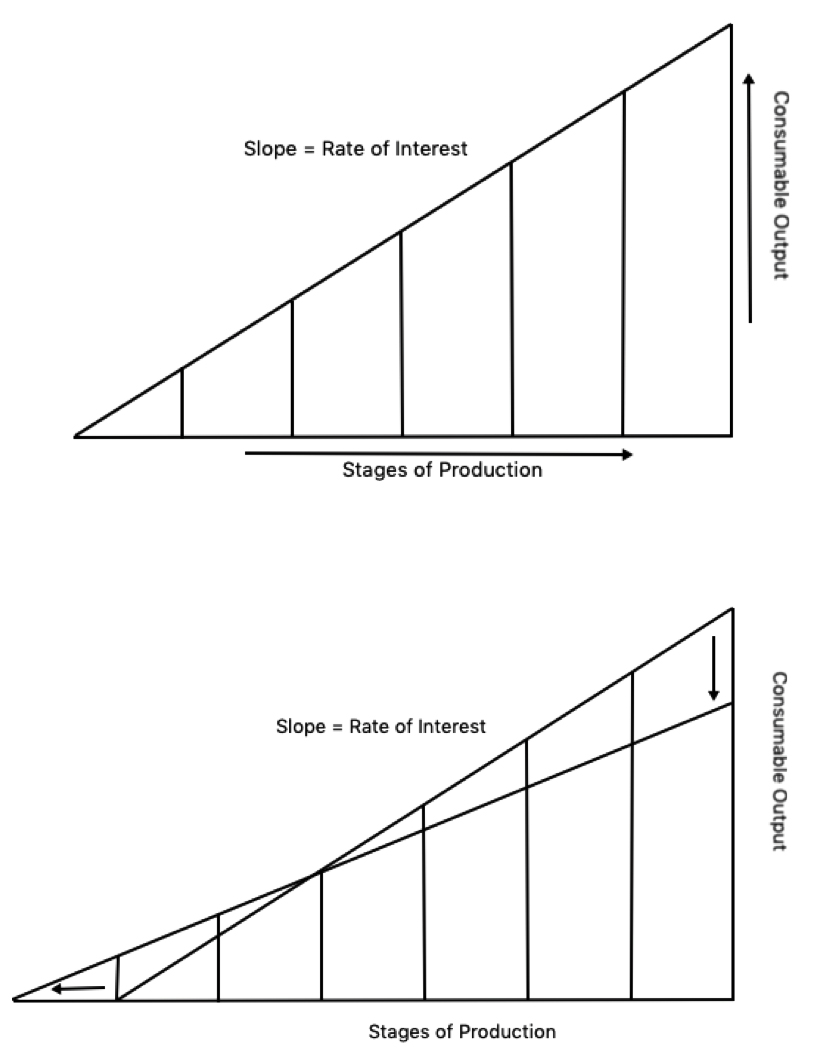

For the purposes of this paper, we will apply Hayekian Triangles to Wyoming government programs. Austrian economist F.A. Hayek used a triangle (Figure 3) to describe the stages of production and how output changes with changes to the investment and savings. When a healthy economy shifts towards savings and investment, the triangle skews (Figure 4). This results in a short term drop in consumption, but long term growth with the extra stages of production. Market driven savings and investment leads to an increase in future consumption.

On the other hand, when an economy becomes less thrifty, the trend reverses. When the government gets involved in this process, it sends conflicting signals to the market. These conflicting signals result in malinvestment and overconsumption.

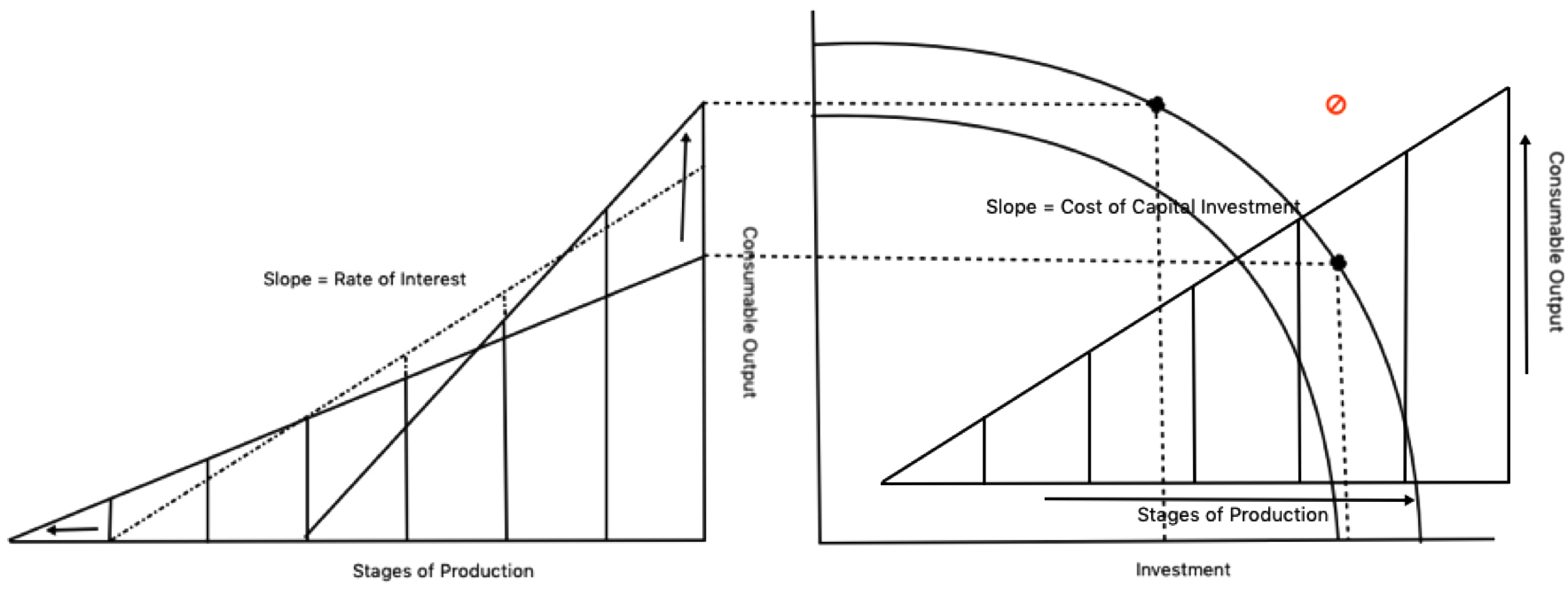

Malinvestment and overconsumption lead to initial booms in the economy but creates busts in the long run. This cycle of boom and bust can be seen when we set the Hayekian triangles next to Production Possibilities Frontier (PPF) curve (Figure 5). The conflicting market signals encourage overconsumption and overinvestment (or malinvestment), which initially results in market growth but subsequently, the market attempts to operate beyond the PPF, which results in a bust.

As Wyoming does not have a direct impact on interest rates, we will be substituting the words “rate of interest” for a more relevant terminology, “cost of capital investment” (Figure 6). The terms are interchangeable in this instance as interest rates are the cost of capital investment for any given business. The modified Hayekian triangle is more applicable to Wyoming’s economy. Now, we can look at how Wyoming’s corporate subsidy programs, such as ENDOW, affect the business model and, in turn, the boom and bust cycle. Viewing ENDOW through this lens will give a better idea of how their proposals (as well as other Wyoming subsidy efforts) will affect the boom and bust cycle.

ENDOW’s 150-page report included a 20-year economic diversification plan. Some of the report’s recommendations involved reinforcing and expanding Wyoming’s public infrastructure — including broadband and roadways. The Wyoming government is willing to gamble with taxpayer dollars to accomplish ENDOW’s goals, and that should be met with sharp scrutiny.

ENDOW’s 150-page report included a 20-year economic diversification plan. Some of the report’s recommendations involved reinforcing and expanding Wyoming’s public infrastructure — including broadband and roadways. The Wyoming government is willing to gamble with taxpayer dollars to accomplish ENDOW’s goals, and that should be met with sharp scrutiny.

Essentially, ENDOW can be viewed as an investment spending arm of the government. Setting aside the fact that ENDOW’s spending is no substitute for private investment, ENDOW’s spending should be seen as a disruption of the market’s resource allocation. One misstep from ENDOW could push Wyoming deeper into economic depression.

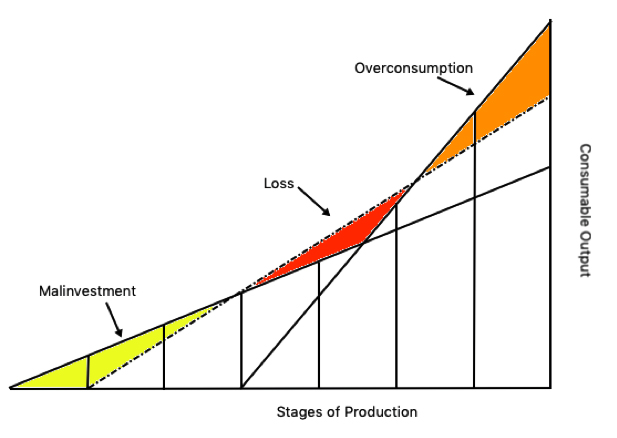

Investment spending and savings are two important factors when measuring economic growth. ENDOW’s attempts to diversify the economy through subsidies fundamentally alters the scales of production for businesses (Figure 7). In a free market system, businesses must use the funds available to allocate resources throughout the production process, from development to sale. Subsidies can have a distortion effect on that process. Allocating new funds, or worse mandating funds for certain purposes, leads to malinvestment. Investment spending naturally responds to long-run models, meaning that subsidy programs, such as ENDOW, send false signals to businesses and accelerate this cycle of booms and busts. Market inefficiency is the result of government interference and uncertainty. An economy will always have some degree of inefficiency through uncertainty, but government furthers this problem through market distortion and misallocation. Under natural conditions, the market coordinates time and interest. When the government injects fiscal stimulus at the expense of Wyoming taxpayers, the boom begins.

Reviewing the ENDOW Report

ENDOW’s twenty-year diversification report covers a wide range of topics, from agriculture to engineering to taxation and education6. The commission sets high goals early in the report, basically promising economic prosperity within twenty years. Their goals are unrealistic for a few reasons, namely, they do not account for any changes in the national fiscal or monetary policy, which would have a direct impact on whether or not they achieve these numbers. They expect an 82% GDP growth during that time frame — 22% of which they directly attribute to their actions7.

Even more curiously, an excerpt of the report reads: “We want to remove the perception that government will be responsible for achieving the plans’ objectives.”8 That statement seems odd in the context of the millions of public dollars the plan requests.

Subsidization Programs

ENDOW requests a billion dollars to be spent developing Wyoming based businesses9. This is where the stages of production will start to skew. In this case, it would have an interesting effect on that Hayekian triangle (Figure 8).

The businesses who receive this subsidy will react to two seemingly juxtaposing ways. One, firms will treat the subsidy like new loanable funds and extend their stages of production. In a healthy market, investment spending is a good indicator for long-run success, but this artificial stimulation results in malinvestment. Firms will use this money to overinvest, whether it is in new production methods or overinvestment in land or facilities does not matter. The extra funds gives incentive to businesses to make poor long-run decisions.

This alone wouldn’t be a big problem if it was not also coupled with the other skew, overconsumption. Because these same funds will not be available in the long run, firms will be incentivized to spend, as opposed to save. This will boost early output for firms.

This boom is particularly problematic, as ENDOW will be quick to claim credit for the early success of their investment programs. The holes in their plan will only appear in the long run, when the overconsumption and malinvestment spending takes its toll. You can see a real-world example of this behavior in a California based company called Solyndra10.

Solyndra was an energy company that received more than $500 million in federal funds as part of the Obama administration’s 2009 stimulus package. Solyndra was quick to expand and invest in new facilities, including a $733 million robotics facility. By 2011, Solyndra went belly up.

Solyndra was an energy company that received more than $500 million in federal funds as part of the Obama administration’s 2009 stimulus package. Solyndra was quick to expand and invest in new facilities, including a $733 million robotics facility. By 2011, Solyndra went belly up.

The shortfall can be seen in the loss sector of the Hayekian triangle. Firms will lose that section in the production process, which creates a fragile business model that centers on both long term investment and high short term output. In short, these firms would be better off without the subsidy money in the first place.

Although Solyndra is an extreme case of malinvestment, it is a prime example of how firms behave with artificial government funding. It would only be a matter of time before you would see similar cases coming from ENDOW recipients, albeit on a smaller scale. This is not to suggest that every ENDOW subsidy recipient will crash and burn in this way, but many firms will, and it will be a direct result of this stimulus spending.

Additionally, the report also requests that 2% of Wyoming’s investment portfolio gets earmarked for home-grown businesses11. This section operates the same way as the billion dollar subsidy program. Logistically, though, there is a problem with allocation. Deciding what businesses receive funding, and how much they receive, is a concern.

Corporate welfare programs such as these often lead to pay-to-play scenarios. Assuring that these investment programs are not abusive or corrupt would be a mountain of a task in a state that already struggles to keep up with transparency requirements. The likely result of these programs is that only businesses that are friendly to ENDOW’s overall agenda would receive funds.

These businesses could crowd out competition through financial competitive advantage, only to be at the mercy of government mandates. Subsidy programs are breeding grounds for government corruption and would have to be diligently monitored. This is a task that may not even be feasible.

Solving for “Market Failures”

This same principle can be exhibited in other parts of the ENDOW plan. The report aspires to “provide government aid to projects that have significant potential, but due to their unique technical and risk characteristics have more difficulty attracting private sector investment.”12 While the report does not use this term, this area is often referred to by economists as “market failures.”

Market failures are usually overblown in the first place. Often times, so-called market failures are really the result of government interference in the marketplace. Even setting that aside, the ENDOW report recommendation is a poor one.

Projects that struggle to attract private sector investment tend to be projects that are not worth the investment at all. If a project can not get funding from the private sector, it means that the private sector does not see the project as profitable or successful.

That leaves the ENDOW project with two avenues. One, the project fails because it was not warranted in the first place, or two, the project becomes a money pit that has to be propped up by government funding every year or else it goes bankrupt. Neither option is good and either way, the taxpayers are on the hook.

The Tax Credit Problem

Wyoming should remain business friendly on the tax side. Currently, Wyoming’s tax code is inviting to most businesses (with the exception of the energy sector), but ENDOW recommends a few changes. Early in the report, ENDOW recommends diversifying the tax base while remaining “business friendly”, which is a red flag for tax hikes13. At the same time, the report also suggests offering “targeted state and local tax credits”14.

Any tax hike is an attack on private enterprise. When businesses look to start up, they must factor in the tax policies of the area in which they wish to operate. As such, any tax increase would be counterproductive to ENDOW’s goal of economic growth.

Worse yet, tax credits are the wrong way to incentivize growth. Tax breaks are a good mechanism, as they simply allow individuals/firms to retain their own money. Tax credits, on the contrary, are a reallocation of funds that gives money to firms that did not necessarily pay in at that amount.

This is a crucial distinction in the report. Tax credits are an example of the age-old phrase, “robbing Peter to pay Paul.” Potentially, under the ENDOW recommendations, businesses could actually profit off of taxes that Wyoming individuals pay. Tax incentives are encouraged, but tax credits are not the correct way to accomplish economic growth.

Conclusion

Wyoming has yet to see any visible boom out of the 2009 recession, but that does not mean that it does not exist. Look at the stagnant growth as its own bubble. Without the expansionary monetary and fiscal policies of the federal government, the economy may have dipped further in Wyoming. However, this artificial propping up of this economy will eventually falter and the economy will dip farther than ever.

ENDOW will only result in unsuccessful cronyist spending15. Wyoming must recognize the inefficiencies of state-based economic planning. This paper does not recognize all the problems in the ENDOW plan, but as it relates to the business cycle, these highlights are enough to amount to poor economic results. Through ENDOW, the taxpayers will be at a loss.

Government spending is not a substitute for real savings and investment in the private sector. When there is real, market-driven, savings and investment, the economy flourishes. Savings and investment spending lead to long-run consumption increases. This is how Wyoming needs to recover. Look to long-run market solutions, not government short-cuts. When government plans for the economy, the stakes are high. Wyoming needs savings and investment plans by the many, through privates firms, not by the few.

Endnotes in the PDF

Download PDF